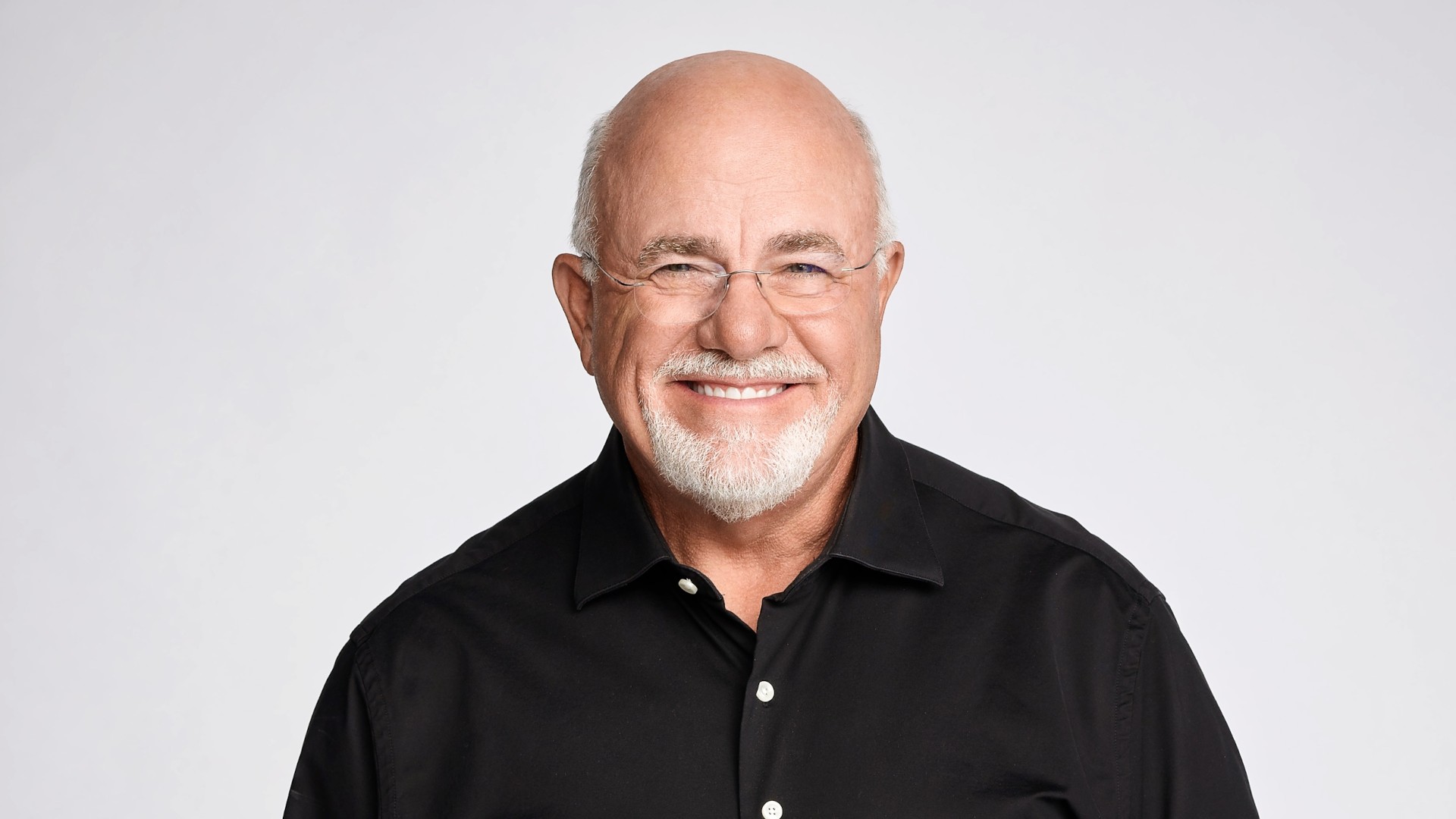

Financial expert Dave Ramsey remains firm in his long-held belief: aggressively paying off debt must take precedence over investing, even if it means delaying wealth accumulation in the short term. His “7 Baby Steps” framework centers on eliminating debt before building wealth, a stance he recently reinforced in a direct response to a 21-year-old caller questioning this approach.

The Core Argument: Intensity and Urgency

Ramsey argues that dividing focus between debt repayment and investing dilutes both efforts. He asserts that the probability of escaping debt significantly decreases if it isn’t tackled with “exclusive intensity.” Splitting attention, he claims, almost guarantees prolonged debt servitude.

“The number of people who drag out student loan debt… is almost zero,” Ramsey stated. “They either do nothing… or they get after it and they knock it out fast.”

The Fast-Track Approach: Aggressive Repayment

Instead of spreading payments over a decade, Ramsey advocates for accelerating debt payoff through aggressive budgeting. He suggested the caller allocate $30,000–$35,000 annually to eliminate $95,000 in student loans within three years, rather than stretching payments over ten.

This rapid payoff, Ramsey believes, frees up financial resources earlier in life, enabling faster wealth accumulation once the debt is cleared. He predicts that following this method could lead to millionaire status by age 35.

The Psychological Factor: Clean Slate Mentality

Ramsey’s approach isn’t solely mathematical; it emphasizes the psychological benefit of eliminating debt entirely. He frames it as “cleaning up your mess” and achieving a “clean slate” that fosters discipline and accelerates future wealth-building.

“Now you can build wealth really, really fast because you’re used to living on very little and paying off a bunch of debt,” Ramsey explained.

The Counterargument: Employer Matches and Compounding Returns

While Ramsey’s stance is firm, critics point out that ignoring employer-sponsored retirement plans with matching contributions leaves free money on the table. Compounding returns from investments, even while carrying debt, can offset interest payments over time.

One commenter argued that balancing minimum retirement contributions with aggressive debt repayment is a more efficient strategy, especially when interest rates on loans are lower than potential investment returns.

The Bottom Line: Discipline Over Optimization

Ramsey’s advice centers on short-term discipline for long-term freedom. While mathematically optimizing investment strategies may yield higher returns, his approach prioritizes eliminating financial burdens and cultivating a disciplined mindset.

The debate highlights a fundamental trade-off: immediate gratification versus delayed gratification. Ramsey’s method favors immediate debt elimination, even at the expense of short-term investment gains